- Lucky Day!

- Great Reads Without the Wait!

- LOL! Comedy Audiobooks

- Workers of the World Unite ... and Read!

- New Children's Read-Alongs

- Oh Mercy Mercy Me (The Ecology)

- Historical Romance by Authors of Color

- African-American Authors: Fiction

- Beach Reads for a Dead Sea Vacation

- So you've watched Bridgerton...

- See all ebooks collections

- Audiobooks Available Now!

- Stuff You Missed in History Class - Listen Alikes

- PCPL Staff Audio Picks: Bet You Can't Hit Pause!

- So you've watched Bridgerton...

- See all audiobooks collections

- Read a Magazine!

- Home & Garden

- Cooking & Food

- Fashion

- News & Politics

- Sports

- Celebrity

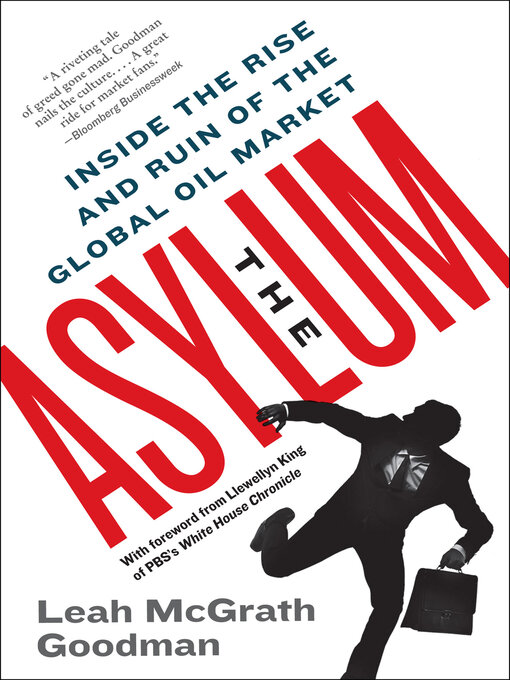

- Business & Finance

- Kids & Teens

- Science

- See all magazines collections